A Commercial Refinance Loan can be a precisely strategical financial instrument that generates flexibility, operational efficiency, and robust economical support for Investors and Business Owners alike. As with most Refinance Loans, Commercial Refinance Applicants typically have two main categories to choose from: a Rate and Term Refinance Loan or Cash-Out Refinance Loan.

One of the most common reasons to Refinance is due to changes in the Interest Rate. As Rates fluctuate, you may opt to Refinance in order to take advantage of a period of lower Rates. Alternatively, a Refinance Loan may be used in order to obtain more favorable Terms, changing the duration of the Loan, or even switching from a Fixed-Rate Loan to an Adjustable-Rate Mortgage (ARM) or vice versa.

A large percentage of Commercial Properties with Mortgages tied to them are involved in an Interest Only style Loan that carries a “Balloon Payment” at the end of the Term. Historically, the Income from the Property, and/or the associated Business, is used to cover the monthly, Interest Only Loan Payments, but when the Loan Term comes to maturity, the Investor must arrange for the Balloon Payment, which can be as much as 85% of the total Loan amount. As the deadline for the Balloon Payment approaches, the Investor customarily envisions a Refinance as the obvious solution. This option affords them the opportunity to transfer the repayment burden while oftentimes simultaneously reducing the repayment cost with a lower Interest Rate. This particular method of Refinance is called a “Rate and Term”, as typically the Loan amount does not change but only the Interest Rate and the component Terms of the Loan.

Another reason for a Rate and Term Refinance is the actual Interest Rate itself. Short Term Loans, and other non-traditional Loan types, often come with higher Interest Rates and sometimes more unforgiving Terms than the more traditional constituents. When initially acquiring the Property the Borrower may not have been in the position to obtain a better form of Financing and may have taken out a Loan that was not conducive to Long Term Cash Flow. Nonetheless, the option to lower the Interest Rate is made accessible through a Rate and Term Refinance.

The obvious appeal of a Cash-Out Refinance is the Cash that you receive at Closing. A Cash Out Refinance gives you the ability to convert your Equity into Cash. Typically you can retrieve 75% of the current Value of the Property. This type of Refinance is not exclusively used to capitalize the Purchase of an additional Property, but rather can provide Cash for any purpose that you so choose. With a Cash-Out Refinance there’s no need to provide proof of an Emergency or any other formal justification. A Commercial Cash-Out Refinance can be an advantageous option for a Commercial Property Owner who is in need of additional Capital without any restrictions.

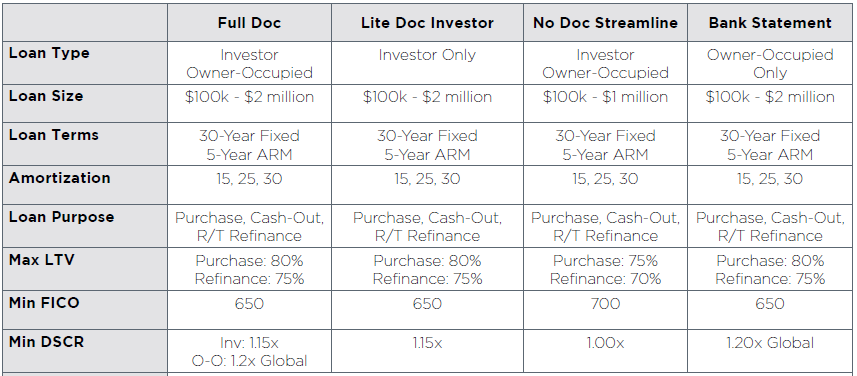

Commercial Refinance Loans hinge significantly on the Debt Service Coverage Ratio (DSCR) to assess Loan applications. The DSCR measures the Net Operating Income (NOI) generated by the Property that is to be covered by the Loan, divided by the total costs of the debt service, including monthly Payments and Interest. A higher DSCR signifies that the Property generates sufficient income to cover the Loan Payments.

Conversely, a lower DSCR can restrict the Loan Amount, reflecting the overall Property’s performance constraints. A DSCR of 1 indicates that a Property’s income can just cover its Loan Payments once, while a DSCR below 1 suggests an insufficient income to service the proposed debts. The DSCR serves as a critical tool in assessing a Property’s ability to generate sufficient income and reduce the risk of default or foreclosure.

DSCR = NOI/ANNUAL DEBT SERVICE

While the formula seems straightforward, accurate figures are crucial for precise DSCR calculation. Calculating the Net Operating Income typically involves using Earnings Before Depreciation, Interest, Taxes, and Amortization (EBDITA). Therefore, incorporating taxes, interest, and other relevant costs into the NOI calculation ensures that the resulting DCR precisely reflects the property’s capacity to cover its debts.

SMALL BALANCE PROGRAMS: