Commercial Purchase Loans, also known as Commercial Mortgages, are specifically designed for acquiring Commercial Properties such as Offices, Storefronts, and Warehouses. These Loans can also be used to purchase larger buildings like Multi-Unit Apartment complexes, Retail Plazas and Malls, Sports Complexes and more.

To determine the amount of funding you can receive, a metric called the Loan-To-Value ratio (LTV) is used. This ratio is calculated by dividing the Loan amount by the Property value. For instance, if your Property is valued at $1,000,000, 70% LTV would equate to a $700,000 Loan ($700,000 / $1,000,000 = 70). Commercial Loans typically range from 50% to 90% LTV, depending on factors such as the Property type, and your Personal and Business qualifications. Contrarily, contributing a higher Down Payment than required, often leads to better Interest Rates and better Terms, as it indicates a lower risk Loan.

The driving factor behind the LTV is what’s called the DSCR, or Debt Service Coverage Ratio. The DSCR assesses the Net Operating Income (NOI) produced by the Property that is to be covered by the Loan, divided by the total expenses of the Debt Service, encompassing monthly payments and Interest. A higher DSCR signals that the Property yields ample Income to meet the Loan Payments. In a figurative sense, if the Property’s value and Rental Income can adequately support the Loan, the possibilities are vast. Access to more substantial Loan amounts becomes feasible, enabling Investment in additional Real Estate or other lucrative opportunities.

Conversely, a lower DSCR can curtail the actual Loan amount, as the figures are confined by the Property’s overall performance. While a DSCR of 1 signifies that a Property’s Income is sufficient to cover its Loan Payments, a DSCR below 1 implies inadequate Income to meet the proposed Debts. Theoretically, the DSCR serves as a measure of a Property’s “creditworthiness” hereby gauging its ability to generate enough Income to cover it’s Debts and thereby mitigating the risk of default or foreclosure.

DSCR = NOI/ANNUAL DEBT SERVICE

While the formula may seem straightforward, it’s crucial to ensure the accuracy of the figures when calculating the Property’s DSCR. Computing the Net Operating Income (NOI) generally entails utilizing Earnings Before Depreciation, Interest, Taxes, and Amortization, or EBDITA as a shorthand term. Hence, before inserting the NOI into the DSCR formula, make certain to incorporate taxes, interest, and any other pertinent costs into the NOI calculation. This step guarantees that the resulting Debt Service Coverage Ratio (DSCR) accurately depicts the property’s capability to meet its financial obligations.

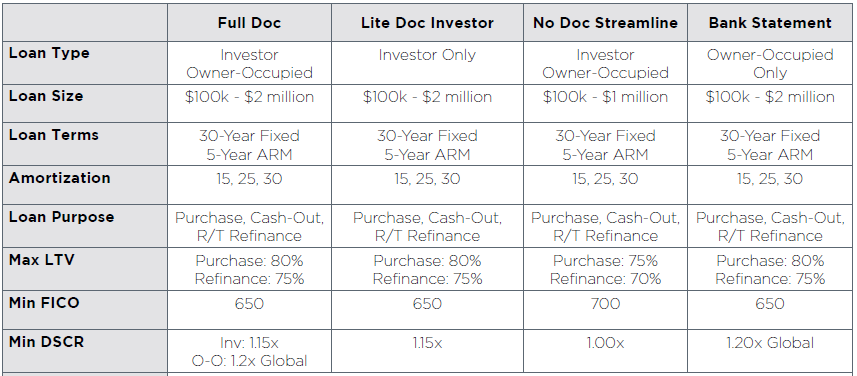

SMALL BALANCE PROGRAMS: